I The Plant

Twelve years ago Clara Dalbert and her husband bought a home near a tiny community called Shell Bluff, close to the Savannah River and about 30 miles southeast of Augusta. Their five-acre spread is everything they’d hoped for in retirement—a rural sanctuary where deer graze and stars glimmer in the night sky.

From the road outside her house, Dalbert can also see steam clouds billowing from the twin gray cooling towers of Plant Vogtle a mile away. Vogtle was one of the last nuclear power plants to come online in the United States before the partial meltdown at Three Mile Island in 1979, an accident that curbed America’s appetite for nuclear energy. Living so close to Vogtle and its two reactors, Dalbert has grown used to the weekly television alerts, the plant-issued emergency radio, the test sirens that sound like an air raid is imminent.

“I’ve thought about those things,” she says. “But I cannot carry them on my shoulder on a daily basis. There’s nothing I can do about it.”

Not long after the Dalberts arrived, Georgia Power announced plans for two more reactors at Vogtle, which would allow it to generate more energy than any other nuclear plant in the country. In 2012 federal regulators signed off on the company’s proposal to build the nation’s first new reactors in more than 35 years.

However you look at it, Vogtle represents an expensive gamble—both for the energy company and its customers. That’s partly because Georgia Power, the largest subsidiary of the country’s second-biggest utility, Southern Company, chose a still-unproven reactor design that has contributed to cost overruns on what is currently projected to be a $17 billion undertaking. The most expensive construction project in state history is already more than three years behind schedule, and the cost of the delays is ultimately borne by the company’s customers, who underwrite the Vogtle expansion with every power bill they pay.

But Georgia Power’s customers aren’t simply paying for a bigger power plant. They’re bankrolling a grand experiment that, if successful, could revive the country’s languishing nuclear power industry and usher in a bright new era of reliable, relatively carbon-free energy. The challenge is a bit like returning to the moon decades after the last astronaut left. While the science behind nuclear energy hasn’t changed, plant specs have, meaning engineers can’t simply dust off their old blueprints. Thanks to decades of operational testing, as well as engineering tweaks, reactors are safer, and the chance of a major meltdown is greatly reduced. But the final cost to build the first new U.S. reactors since Jimmy Carter occupied the White House is, in a very tangible sense, anybody’s guess.

II Why nuclear & why now?

A fifth of the country’s energy comes from nuclear power, but it was supposed to be much more. Most of the nation’s 99 nuclear reactors went live in the 1970s—not long after the Apollo lunar missions, a time of unbridled optimism in the promise of science. Plant Vogtle, which broke ground in 1974, was named after Southern Company’s then chairman Alvin Vogtle, a self-effacing Alabaman whose World War II exploits inspired Steve McQueen’s character in The Great Escape.

Georgia Power had anticipated that Plant Vogtle would be capable of producing enough energy to light more than half of Georgia’s homes. Compared to the company’s Plant Hatch—the state’s first nuclear plant, whose two small reactors had cost nearly $1 billion—the four planned reactors at Vogtle seemed a relative bargain, projected to cost just $660 million.

Then came trouble. In 1979, as the utility was building Vogtle’s first two reactors, Pennsylvania’s Three Mile Island nuclear plant suffered a partial meltdown. While no injuries were reported, the accident was followed by the Chernobyl disaster in 1986, leading to a new wave of federal safety regulations that nearly crippled America’s nuclear industry. Building costs skyrocketed, prompting utilities nationwide to nix plans for more than 50 new reactors, including the second pair of Vogtle units. By the time the plant began generating power in the late 1980s, Southern Company had spent almost $9 billion on the project and come close to bankruptcy.

As the U.S. retreated from nuclear power, though, other countries doubled down. Worldwide, energy output from nuclear plants quadrupled in the two decades after Three Mile Island. Today 30 other countries operate reactors, with France, which produces three-quarters of its power from nuclear, leading the way. China plans to double its nuclear capacity by 2020, making it the fastest-growing nuclear player in the world.

By the late 1980s, polls showed that more than half of Americans believed nuclear energy was too risky. Since then, public sentiment has shifted as environmentalists turned their focus from glowing fuel rods to global warming, targeting the fossil fuels like coal and natural gas.

Southern Company, which operates the top two U.S. power plants for carbon emissions and has long been cited as one of the country’s biggest polluters, has in recent years moved away from its longstanding reliance on coal. In the mid-1990s about two-thirds of Georgia Power’s electricity came from coal; today it’s closer to a quarter. Half of its energy now comes from natural gas.

A decade ago, amid the slow thaw of nuclear opposition, the Bush administration offered huge federal incentives in the form of loan guarantees, tax credits, and risk insurance to companies willing to invest in nuclear energy. American utilities, including Southern Company, rushed to propose more than 30 new reactors.

Then came more trouble: first the Great Recession, then a free-fall in the price of natural gas, which made nuclear less appealing. Southern Company, however, marched ahead with its application to build Vogtle’s third and fourth reactors after the Obama administration in February 2010 approved more than $8 billion in loan guarantees.

“America [has] an aging nuclear fleet,” said Thomas Fanning, Southern Company’s chairman, president, and CEO, in a 2014 interview. “We’ve got to reverse the trend in America that nuclear is ceasing to be as important. It is clean, safe, reliable, and affordable. Therefore, the United States government in their wisdom [created] some incentives to promote new nuclear. That’s where we stepped forward.”

Only SCANA, which is building two reactors at its V.C. Summer Plant in South Carolina, has followed suit. (The Tennessee Valley Authority turned on its Watts Barr 2 reactor this year, more than four decades after construction began.) All other proposals have fallen by the wayside. Despite the incentives offered, the big question mark posed by nuclear power—the unknown final cost of construction—remains too risky for most utilities.

Even after an earthquake and subsequent tsunami triggered a meltdown at the aging Fukushima plant in Japan in 2011, the Nuclear Regulatory Commission green-lit Vogtle Units 3 and 4. With their updated design, Southern Company assured regulators the new reactors would be able to withstand damage caused by a natural catastrophe like an earthquake or a direct hit by an airplane.

Photograph by Dustin Chambers

III How much will it cost?

The short answer is: a lot. The long answer is that, more than halfway through the site’s construction, no one knows for sure. When Georgia Power first sought permission to build the two new reactors, it estimated the project’s total price tag would be $14.5 billion. Then construction began. Within two years, forecasted costs started to climb. For instance, the utility hired a Louisiana-based manufacturer that had never before worked on a nuclear project to build part of the reactors. In an industry known for meticulous record-keeping, the company submitted quality control paperwork riddled with errors, resulting in a year’s worth of delays. And, until recently, Georgia Power was locked in lawsuits with contractors over licensing delays and design disputes. At the end of last year, the total cost was adjusted to $17 billion. But with at least 44 months left until both reactors go online, it could go as high as $21 billion, according to one utility expert who testified before state regulators last December.

IV And who’s paying for it?

If you need a cure for insomnia, then research just how electric utilities are set up in Georgia. Of the nearly 100 energy suppliers, Georgia Power is the only one owned by private investors and thus the only one directly regulated by the Public Service Commission, the five-member elected board that regulates the state’s utilities. Most of the rest of the suppliers are members of MEAG (Municipal Electrical Authority of Georgia) or part of Oglethorpe Power, both nonprofit entities. As it turns out, MEAG and Oglethorpe, along with tiny Dalton Utilities, are also helping foot the bill for Vogtle’s new reactors, in return for a share of the power they will generate. By far the largest stakeholder, Georgia Power has taken the lead on construction.

As a regulated utility, Georgia Power is obligated to provide electricity to parts of the state not served by other suppliers. But it gets something back, too, enjoying what amounts to a guaranteed return, between 10 and 12 percent, on capital investments like building power plants.

“People don’t recognize that we are capital intensive,” Georgia Power CEO Paul Bowers has said. “Billions of dollars on an annual basis are being spent . . . [and] anybody in the state that puts in a new business, a new house, a new trailer—we have to serve them. There’s no question [as to whether] we can say no.”

The new Vogtle reactors certainly qualify as a capital investment. But according to attorney Bobby Baker, a former PSC member, there’s little financial incentive for Georgia Power to avoid construction delays, since the company still collects its percentage on cost overruns. The utility must go before the PSC twice a year to seek permission to pass Vogtle’s construction costs on to consumers, but so far the PSC has approved every one of its requests.

“Most of the time, when you have a construction project, the contractor is held accountable with a fixed price,” says Baker, who says the PSC has allowed Georgia Power to operate as if it has a “blank check.”

Right now Georgia Power’s share of the project’s cost amounts to $7.8 billion—at least, that was the most recent estimate, as of the end of last year. When the utility built the first two reactors back in the late 1980s, the expenses almost bankrupted the company because, under longstanding state rules, it couldn’t bill ratepayers until the project was finished. This time around, Georgia Power realized it needed to change its approach.

In 2009 the utility (not coincidentally one of the state’s most prolific political donors) successfully lobbied lawmakers to allow it to bill customers up front for the financing costs needed to build the new reactors. In doing so, the utility said, it would reduce interest payments by hundreds of millions of dollars that, in turn, would lower customers’ electric bills. The financing costs aren’t insignificant: They amount to $2.4 billion—a third of Georgia Power’s portion of the Vogtle 3 and 4 costs.

That $2.4 billion is coming from Georgia Power ratepayers, whose bills have a line item called the “nuclear construction cost recovery rider.” It’s possible you may have missed the increase—for the average ratepayer, it totals $81 over the course of a year—because it’s been offset by the lower cost of energy overall. As Georgia Power spins it, the average annual bill has gone down by $53 over the past five years because of the savings incurred by using natural gas that, at least for now, is cheap. Of course, if ratepayers weren’t also paying for the financing of two new nuclear reactor units, the average bill would have dropped even further, by $134.

For the rest of Vogtle’s construction costs, currently projected at $5.4 billion, Georgia Power intends to sell stock to pay for half of it and borrow money to cover the rest.

V How do you build a nuclear reactor unit?

“There’s work going on 24 hours a day,” Mark Rauckhorst yells over the cacophony that’s a constant on the Vogtle site. “If I need to know something, my guys will text me in the middle of the night.”

The 58-year-old Georgia Power exec in charge of construction usually arrives at his drab trailer just before dawn. There, he oversees the more than 6,000 workers who have temporarily made Vogtle one of Georgia’s 25 largest employers. They’re tasked with installing a pair of Westinghouse AP-1000 reactor units, a model so new that none have yet generated a single watt of energy anywhere in the world. Later this year China is expected to power up the first AP-1000, but because the U.S. has stricter regulations, Rauckhorst, a nuclear engineer, basically has to troubleshoot the reactors as they’re being assembled.

“Somebody’s got to be first,” he says. “Somebody’s got to work out all the kinks.”

Because of Georgia Power’s contractor disputes, the reactor units are only a third complete. So far, Rauckhorst says, his workers have logged more than 16 million hours on-site without missing a single day due to injury. He expects construction on the two units to be finished and fuel loaded in 2018 and 2019, respectively.

Rauckhorst is now supervising the pouring of 400,000 cubic yards of concrete—enough to build the new Mercedes-Benz Stadium twice over—that include two cooling towers, each taller than the Atlanta Marriott Marquis. Now comes the hard part: fitting together reactor unit pieces shipped from across the world by companies hired to manufacture sections of the AP-1000.

Inside a cavernous warehouse near Rauckhorst’s trailer, scores of workers weld steel panels together into giant structures that weigh millions of pounds. From there, a 50-story derrick capable of lifting five jumbo jets at once hoists the panels into place. A reactor unit is like a mammoth Russian nesting doll: a 30-story building surrounding a nearly two-inch-thick steel shell that, in turn, encloses the 375,000-pound reactor.

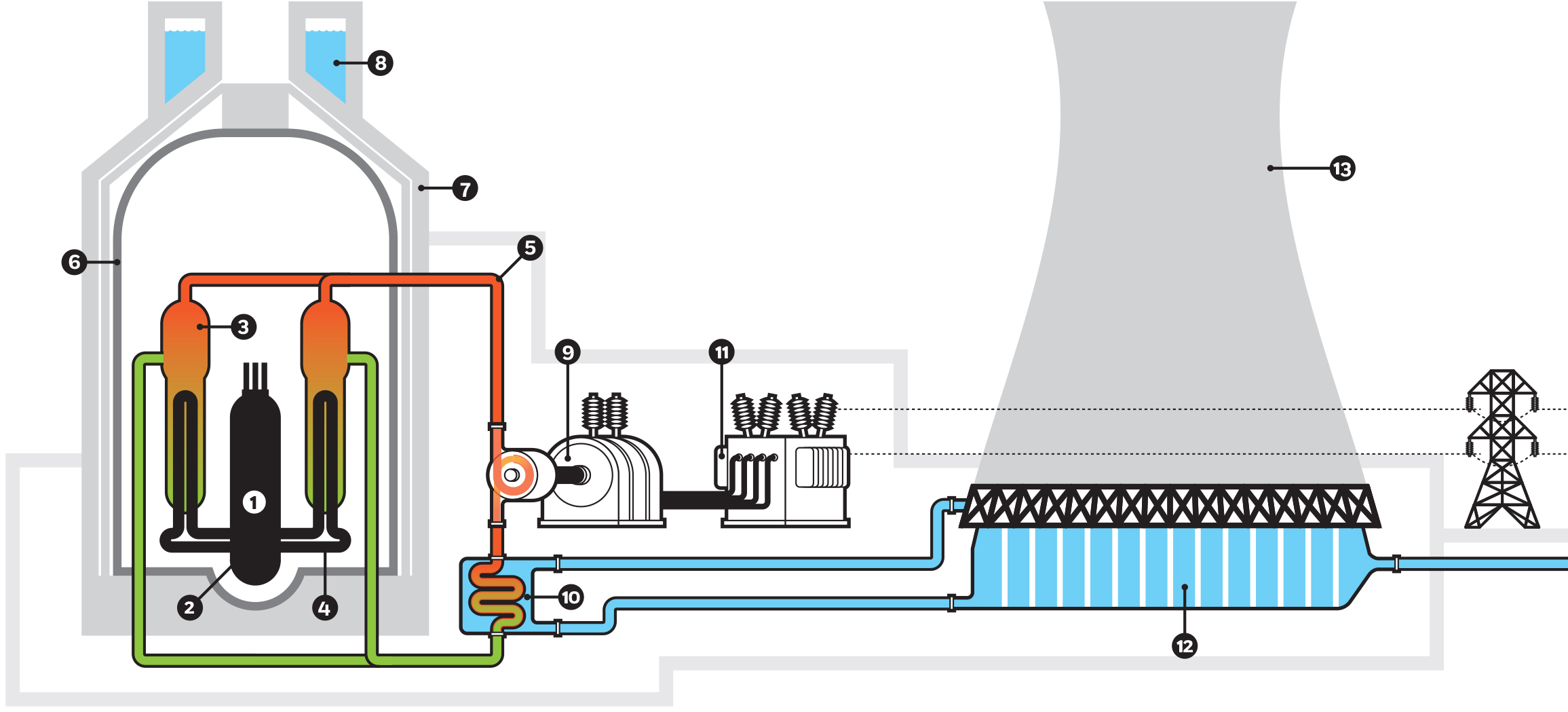

Inside each unit, nuclear energy is created when uranium atoms contained in fuel rods release neutrons that split other uranium atoms, leading to a controlled chain reaction. Heat from the reaction is used to boil water into steam that turns giant turbines, generating electricity. The reactions can be slowed or halted by inserting “control rods” composed of material that absorbs neutrons. The system is cooled by water that is drawn from the Savannah River; the water itself is cooled by the towers.

Once Vogtle 3 and 4 are each finished, testing can begin. Southern Nuclear, Southern Company’s operating arm in charge of running the reactors, will enrich raw uranium sourced from four continents that’s been shaped into pellets and loaded into fuel rods. By then, Southern Nuclear engineer John Umphlett, who worked on nuclear subs throughout his lengthy Navy career, will have trained the newest reactor operators in a replica control room.

The AP-1000 has fewer parts than previous reactors, which should make it less likely to break down, says Umphlett. In the past, operators needed to switch on a pump to cool a reactor to avoid a meltdown. Under the current design, thousands of gallons of water stored above the reactor would simply fall onto overheating fuel rods if the plant’s backup power source went out, making the process failsafe. Operators will work 12-hour shifts in teams of five, equipped with a wall of monitors displaying readings unintelligible to the untrained eye. Like the current construction site, the plant will run around the clock, transmitting energy from one corner of Georgia to the rest of the state, including your living room.

Atoms at work

While the twin Westinghouse AP-1000 nuclear reactors being installed at Plant Vogtle boast technological and safety advances, they perform a familiar function: to super-heat water into steam to turn turbines that generate electricity. The water used to cool the system is separated from the water used to run the turbines. Here’s a cross-section of how a reactor works.

- Fuel

- Reactor vessel

- Steam generator

- Coolant pipes

- Steam lines

- Steel containment

- Concrete contaiment

- Passive containment (cooling water)

- Turbine generator

- Condenser

- Transformer

- Cold water basin

- Cooling tower

VI But what’s wrong with other forms of energy?

Every form of energy has pros and cons. Coal has traditionally offered cheap, reliable power but is a major source of pollution. While renewable sources such as solar and wind are emissions-free, the technology is expensive and the results can be inconsistent on a mass scale. Hydroelectric power is efficient, but Georgia lacks the natural water resources to expand this kind of production. Natural gas is cleaner to burn than coal and its cost is at an all-time low, but fracking, the process of extracting the fossil fuel out of subterranean shale deposits, can also harm the environment. So to hedge its bets against price fluctuations and environmental regulations, Georgia Power invests in all of the above, adjusting the output of its many power plants and dams as needed. If the utility were to run all of its plants continuously, nuclear energy would account for 9 percent of the electricity produced. Once both of Vogtle’s new reactors eventually go online, they should boost that figure to 14 percent. That’s well beyond the 2 percent now generated by renewables, which is projected to increase to only 6 percent by 2020.

While nuclear power produces radioactive waste, it’s carbon-free and doesn’t depend on environmentally destructive extraction methods to the extent that coal mining, fracking, or deep-sea drilling does. Obama’s former Secretary of Energy Steven Chu declared nuclear the “lesser of the two evils” compared to fossil fuels, in part because a single, pea-sized uranium pellet can generate nearly the same amount of electricity as a ton of coal. In fact, Columbia University researchers found in 2013 that nuclear power could be credited with averting 76,000 pollution-related deaths a year worldwide during the 2000s.

What’s more, the EPA is restricting power plant emissions to fight global warming. New regulations prompted Georgia Power last year to shift the production of 2,000 megawatts away from its coal- and oil-fired plants, which increased the demand on its two nuclear plants. Georgia Power spokesman Jacob Hawkins says Vogtle’s new reactors represent insurance against a future rise in fuel prices by offering consistent, low-cost energy.

VII Is nuclear safe?

Of course, nuclear power comes with plenty of baggage. Everyone knows about the potential for disaster—think Chernobyl and Fukushima—that could force mass evacuations, cause long-term health problems, and even kill people. Other concerns include radioactive contamination, environmental damage, and the dilemma of nuclear waste.

Let’s break each down, starting with the potential for nuclear meltdown. Since the early 1950s, the International Atomic Energy Authority has documented only three dozen incidents worldwide, ranging from near accidents to radioactive disasters, with most being relatively minor. Advances in plant safety have greatly reduced the risk of major accidents. For any given plant, such accidents are predicted to occur, on average, only once every 20,000 operating years—many times longer than the intended 60-year lifespan of Vogtle’s new reactors.

Still, some residents of the largely poor, black Burke County, where Vogtle is located, believe the plant is linked to an increased incidence of health problems. Bernice Johnson-Howard, a local activist, cites a

decade-old study from environmental advocacy group Blue Ridge Environmental Defense League that used CDC data to determine that the local cancer mortality rate had increased by a quarter since Vogtle first went live in the late 1980s. Georgia Power contested the cancer link, citing other government studies, but said it would review the group’s findings. Johnson-Howard says the University of Georgia’s Savannah River Ecology Lab will soon begin a three-year environmental monitoring program—the first such effort since 2003—to see if increased radioactivity is present in the local air, water, produce, and soil. The utility, which self-reports the release of contaminations, insists it has complied with environmental regulations.

Far more certain, according to the Southern Alliance for Clean Energy’s Sara Barczak, is the environmental harm that comes from the amount of water Vogtle will guzzle from the Savannah River. Once all four reactors are online, the plant is expected to use nearly 150 million gallons a day—enough to provide drinking water for more than 1 million people, double the population of the city of Atlanta. The combined impact of the withdrawals and climate change on the river hasn’t been adequately studied, she says. Nevertheless, state environmental regulators are expected to permit the utility to extract that much water as soon as the plant is up and running.

Then there’s nuclear waste. Each year the average nuclear plant generates around 20 tons of spent radioactive material for which there’s no permanent home. Back in 1987, Nevada’s Yucca Mountain was designated as the nation’s nuclear waste dump, but political pressure helped scuttle that plan. Like most other U.S. nuclear plants, Vogtle stores its radioactive waste on-site in steel-and-concrete “casks.”

VIII What could Vogtle’s completion mean for the nuclear industry?

Seven years ago, Georgia Power announced its first new reactor would go live on April 1, 2016. Due to subsequent delays, the utility doesn’t expect to turn on the reactor until June 2019, with the second one going online a year later. Vogtle critics, however, believe more delays are coming.

For every day Vogtle’s expansion falls behind schedule, Georgia Power’s costs go up by $2 million, slowly canceling out the savings the company had promised back when it lobbied to bill customers in advance for construction financing. There is no limit on how much it can precollect—a state bill introduced this year to set a cap didn’t even receive a committee hearing—meaning ratepayers could end up on the hook for another $1 billion on top of the $2.4 billion they’re already paying, says Liz Coyle of the consumer watchdog group Georgia Watch.

That’s especially important when you consider that the country’s nuclear energy industry will be watching closely over the next four years. Already Georgia Power’s Rauckhorst has given a number of plant tours to executives from other energy companies interested in building their own new reactors. He believes Vogtle eventually will help catapult the country into a long-awaited nuclear renaissance. That may only happen if the utility can avoid major hiccups moving forward.

“They want to see that, one, it would work, and, two, it can be built,” he says. “We’ll prove it. Then they’ll build these things.”

Meanwhile, Georgia Power has already started looking beyond Vogtle. The utility this year asked the PSC for permission to bill customers $175 million to study the feasibility of building the state’s third nuclear plant on 7,000 acres of woodland it owns along the Chattahoochee River 20 miles south of Columbus, a project that could take upwards of 20 years to complete. Barczak contends that, beyond the prospect of another rate hike for consumers, the proposed plant would further damage the Chattahoochee, which is already threatened by the contentious “water wars” between Georgia and its neighboring states. Even some PSC members, including those who have traditionally thrown support behind all things Georgia Power, have appeared reticent to move full steam ahead with another costly plant project before the current one proves successful.

“My hesitancy is that Vogtle 3 and 4 are not complete yet,” said PSC Chairman Chuck Eaton. Commissioner Bubba McDonald, another Vogtle supporter, initially told Georgia Power representatives, “If it’s that good, and you believe it, why don’t you put the money up yourself?” Still, in July the PSC voted to let Georgia Power spend up to $99 million to study whether it should build another nuclear plant.

For now the future—for Georgia Power, for the nation’s nuclear industry as a whole, and for ratepayers’ pocketbooks—rests with Vogtle. To hear utility executives talk, when Vogtle is complete, it will usher in decades of relatively cheap, sustainable energy. But first the company must finish the plant and get it running, a feat that hasn’t been achieved in this country in a generation. Only then, when Vogtle’s final costs have been tallied, can anyone say whether Georgia Power’s grand gamble will have paid off.

This article originally appeared in our October 2016 issue.

![The North Carolina Museum of Natural Sciences’ newest exhibit is a [pre]historic first](https://cdn2.atlantamagazine.com/wp-content/uploads/sites/4/2024/04/DD-3-100x70.jpg)